YOUR ROADMAP TO BECOME A FINANCIALLY FREE HOMEOWNER?

Reserve Your Seat at Our Next Home Buying Ready Tour!

What You'll Discover

In This Exclusive MASTERCLASS, You'll Learn:

The exact steps from A-Z

How to get pre-approved — even with less-than-perfect credit

What banks and lenders really look for (and how to prepare)

The truth about down payments, grants, and hidden fees

How to avoid costly first-time buyer mistakes

Real strategies that have helped hundreds of renters.

This is perfect for you if

You’re a first-time

home buyer

You feel overwhelmed or don’t

know where to begin

You PAID A MORTGAGE BUT

IT WASN'T YOURS

You’ve been told you don’t qualify

but still want to try

Meet the COACH

Who will be teaching the Home Buying Ready Masterclass

Marcia L Smith

HOME BUYING COACH, REAL ESTATE INVESTOR, REALTOR, WIFE AND MOTHER.

From starting my own home buying journey and having no clear direction on what to do or who to connect with for help, I managed the hard and the very long way but I got it done.

.....................

Which fueled me to do something to help other first-time buyers not to endure the stress and frustration I went through when buying my first home.

.....................

I got licensed as a Loan Officer and Realtor to learn the business from both sides of the home buying process.

.....................

I’ve seen first-hand how a large number of first-time buyers get tossed to the side because they are not home buying ready.

.....................

When renters were hesitant to even try again with fear of being let down and left with unanswered questions or directions on what to do, I excitedly admitted that I was different and I would get it done.

In 2014, I started the Home Buying Club and started educating renters on all of their home buying options.

.....................

The challenges they thought would prevent them from buying.

.....................

The fear of embarrassment of being judged.

.....................

I took them by the hand and helped them get home buying ready and closed.

.....................

And now, I want to help you too!

.....................

You will learn the entire home buying process in one day with me. And the best part is, I have literally created a solution for every problem. Just show up and I’ll walk you through the process step by step! It doesn’t get any easier than that.

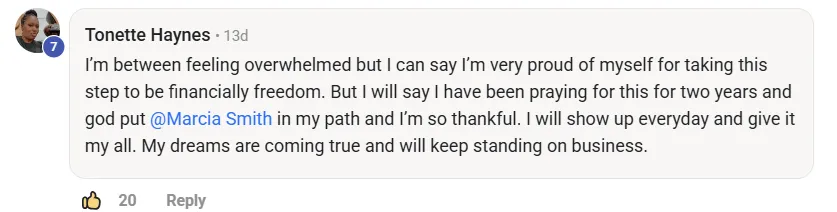

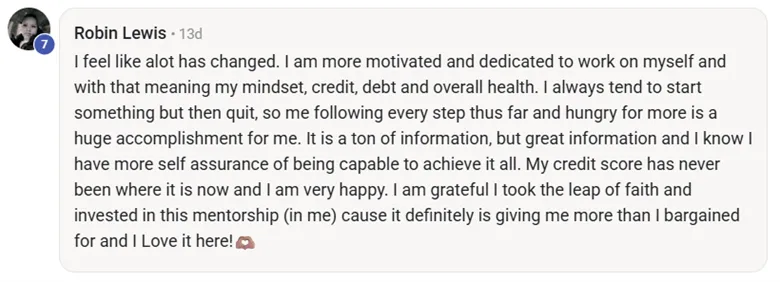

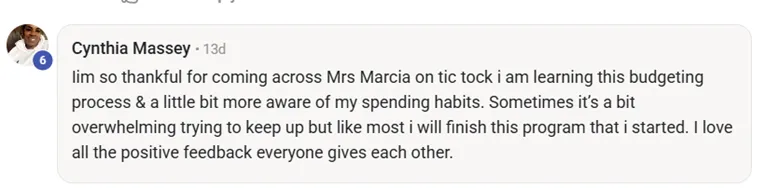

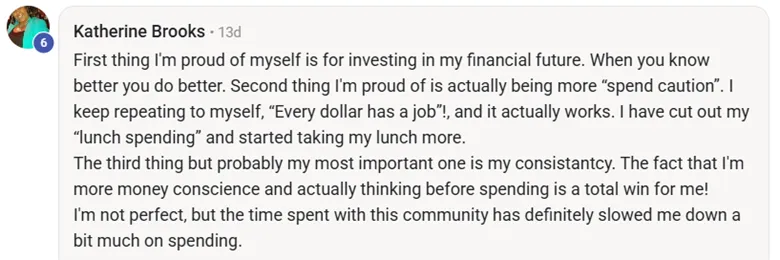

What Our Clients Are Saying

Want a sneak peek into the Home

Buying Ready Masterclass?

Build the Foundation

When I said, no fluff...I meant it!

How to layout your strategy to start shopping for your home!

How to get connected to your home buying resources.

How to see where you are today!

How to determine what you need and the solution to your challenge to get home buying ready.

Get Organized

If you feel you are all over the place, this session

is going to CHANGE YOUR LIFE!

How to see where your money went. Now you can save more!

How to get approved for the home you want.

The steps to pay off debt fast!

Financial requirments for pre-Approval.

Banking for success

How to conduct a family meeting.

How to be held accountable. Who’s making sure you’re getting things done to meet your deadline.

Home Loan Ready

STOP guessing if you’re home buying ready, follow the

steps we teach and get ready!

How much can you afford.

How to get your credit pre-approval ready.

How to increase your credit scores 120 points.

What underwriters want to see to increase your approval.

Down payment strategy to close with $0.

How to guarantee you will close. Top 10 secrets they don’t want you to know about home buying. Until now!

Reserve Your Seat at Our Next Home Buying Ready Tour!

General

Total Value $997

Today $97

9:00 – 4:00

6 Hours of Home Buying A-Z Process

Where to Start and Create Home Buying Plan

Credit Report Review and Clean Up Credit Report

How to Increase Credit Scores Up to 300 Points

How to Get Credit Pre-Approval Ready

How Much Can You Afford

Which Loan Programs Are Best

How to Leverage Down Payment Assistance

Which Programs Have No Income Limit

How to Close With $0 Down & $0 Closing Cost

How to Get Money Back at Closing

Documents Needed for Pre-Approval

$100,000 Secret Banks Don’t Want You to Know

Collections and Student Loan Lies

2 Additional Bonus Hours

Mock Pre-Approval Submissions

How to legally increase your income up to $2000 in 2 weeks.

Real Estate Investing – Fix & Flips

Real Estate Investing – Buy & Holds

Real Estate Investing – Tax Deeds

Still Got Questions?

Do I need perfect credit to buy a home?

Not at all. In the masterclass, we’ll show you how people with less-than-perfect credit have qualified — and how to improve your score quickly if needed.

Is this masterclass really free?

Yes, 100% free. No hidden fees, no upsells required. We created this to help renters take their first step toward homeownership with confidence.

How long is the masterclass, and can I watch it anytime?

The masterclass is under 45 minutes and available on-demand, so you can watch it at your own pace — anytime, anywhere.

I don’t have a down payment saved can I still buy a home?

Yes. We cover several low down payment loan options, grants, and strategies to help you buy with as little as 3% down.

Will this work in my state or city?

Absolutely. The steps we teach apply nationwide, and we’ll also show you how to connect with local professionals who know your market.

I’m not ready to buy right now should I still join?

Yes! This class is perfect if you’re planning to buy in the next 3–12 months. The earlier you prepare, the smoother the process will be when you’re ready.